Lien Basics

Anyone who has worked in construction in any capacity has probably heard of a lien but few people know what they are and even fewer people understand what they do. We occasionally have to lien properties to protect payment. We’re glad to say it doesn’t happen a lot, and many times it is not even the homeowner’s fault. In today’s post, we’re going to discuss what a lien is, what it does, and why they are useful tools for contractors. We will also cover what to do if you have a lien placed on your property.

What is a Lien?

A lien is when one person, or company, has a legal right to keep possession of someone else’s property until a debt is paid. There are several types of liens including bankruptcy, mortgage, mechanic, and car liens. In construction, we deal with mechanic’s liens almost exclusively.

So what is a Mechanic’s Lien?

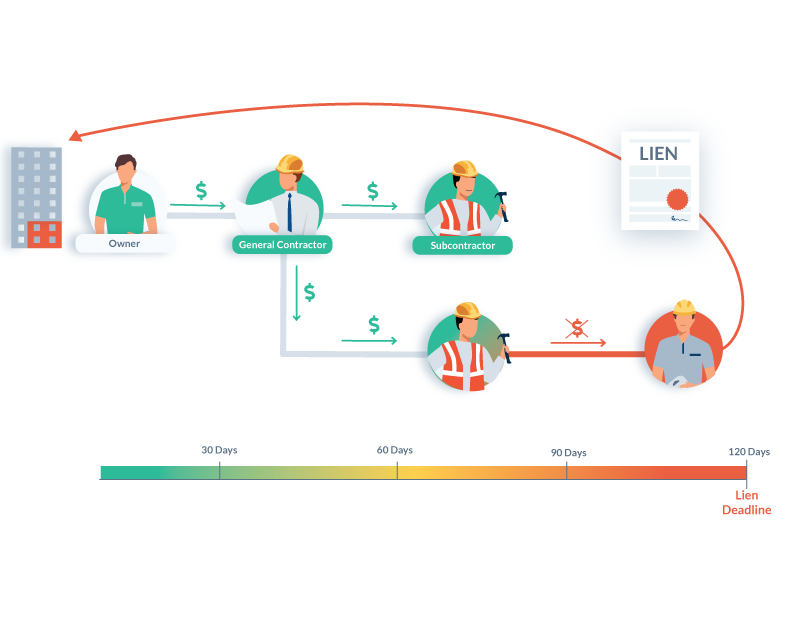

Despite the name, mechanics liens are generally used by construction contractors, subcontractors, and suppliers and are filed on the property they work on. For instance, if our roofing company replaces a roof we can file a lien against the property where the roof was replaced for the amount of the materials and improvements made. If payment is not received once the lien is filed, the construction company can foreclose on the property in the same manner that a bank can when a mortgage doesn’t get paid.

How do they work?

Lien laws differ from state to state; however, generally, a subcontractor or material supplier who does not have a contract with the property owner will have to provide notice to the owner that they are making improvements to the property. A party who has a contract with a property owner generally does not have to file any notice before filing the lien. They can file the lien and then foreclose on the lien as provided by state statutes. But this does vary from state to state so anyone needed to file a lien will need to check their state statutes.

But my insurance company owes the money?

We do a lot of restoration work in North Carolina and as I’m sure you can imagine this year we are doing a lot of work that is covered by insurance. The insurance companies are swamped with claims, so processing and check writing can be very slow. Now, technically the contract is between the construction company and the homeowner so the homeowner is ultimately responsible for payment but we know and understand that the homeowner is depending on the insurance proceeds to make payment.

However, state law usually requires construction companies to file liens within deadlines or they lose all their lien rights. For instance, in North Carolina, we only have 120 days from the last day of work to file a lien. Because of this, many times we have to file a lien when we have every expectation that the bill will be paid as soon as the insurance proceeds are received by the homeowner. Because of this, you do not need to panic if a lien is placed on your property. It is easily removed once payment is made and does not affect your credit unless the lien has to be foreclosed on.

So what happens when a lien is filed and a then the bill is paid?

Once payment is received, we file a release of lien with the same office where the original lien was filed, usually the county recorder’s office. It’s a very simple and quick process that usually will clear the property of the lien in 24-48 hours after filing depending on the county.

Liens are great tools that construction companies can use to protect payment but the requirements differ from state to state and must be filed carefully and judiciously. You may want to consult an attorney if you would like to file liens but have no experience with it. If you are going to utilize liens, it is also helpful to have an employee in place that can answer any questions about the lien and ensure the release is filed immediately after final payment clears.

If you have any questions or would like to request a Free No-Obligation Estimate visit our website at PatriotRoofer.com or call us today! We are headquartered in Wilmington but service from Raleigh to Myrtle Beach!